Our story

Keystone - Lay the groundwork for success

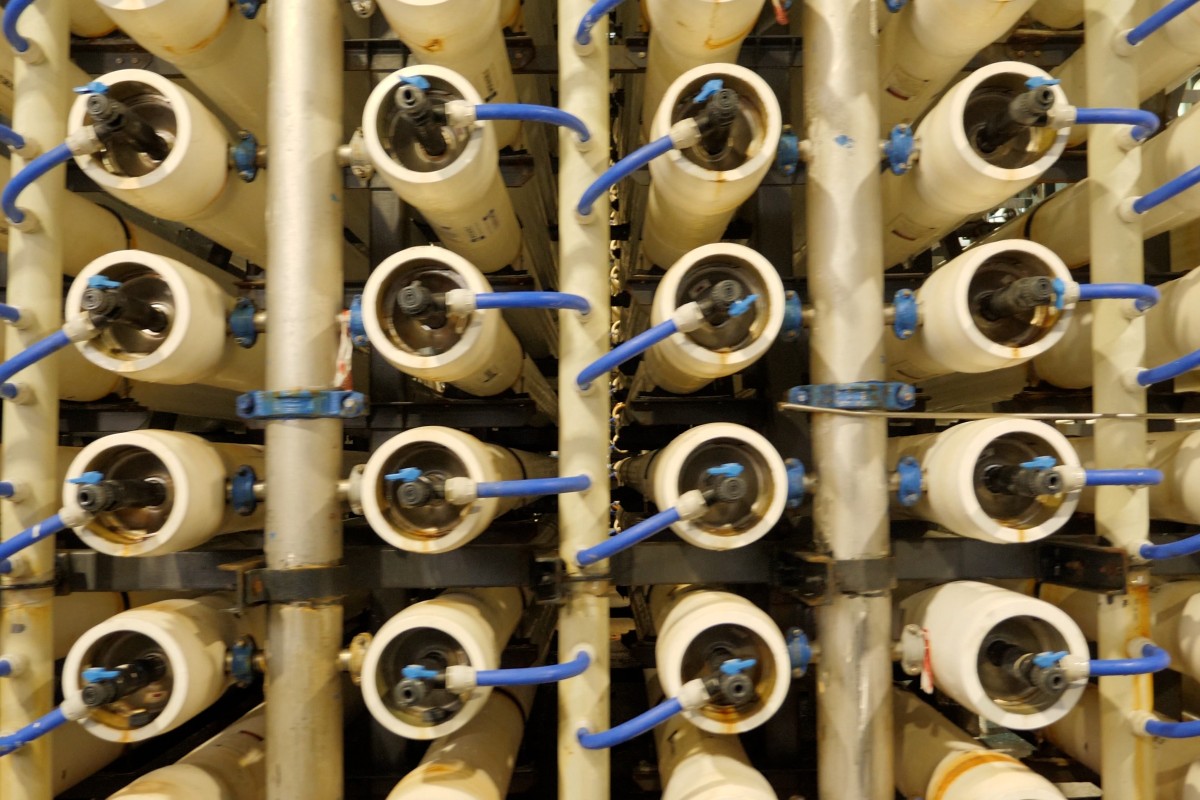

Keystone Fund is an Israeli infrastructure investment fund established in 2019, as part of the government's policy to promote and encourage investments in infrastructure in Israel, including water, wastewater and waste projects, energy infrastructure, transportation and PPP projects.

The fund's founders are entrepreneurs Roni Biram (who serves as chairman of the board), Gil Deutsch and the fund's CEO, Navot Bar.

Since its establishment, Keystone has raised capital in the amount of approximately NIS 1.35B. Keystone is a public traded company on the Tel Aviv Stock Exchange since June 21. As a public company, it operates in complete transparency and is committed to reporting. If and to the extent that the regulation of investment funds in traded infrastructures takes effect, Keystone will be obligated to distribute most of its taxable income as dividends to its investors.

The people who make the difference

Keystone's team of executives is made up of leading professionals in their field who have a proven track record of success. They bring with them extensive knowledge of the real estate market, with an emphasis on financing, construction, development and operation of infrastructure assets, along with vast experience in the capital market.

This combination makes Keystone a link between the capital market and physical infrastructure, and assures the identification of profitable projects and execution of complex transactions with promising return potential.

Our approach

Keystone's goal is to form and establish a balanced and diverse investment portfolio that will offer its investors a long-term return, with as little risk and fluctuations as possible.

To ensure this, we use three key values as our guidelines in every investment we make

Expertise - performing preliminary tests to ensure that the transaction is profitable and that risk diversification is carried out optimally among stakeholders in each project or transaction

Conservative investing - controlled risk-taking to provide investors with certainty and confidence

Creativity - creative thinking in transaction planning, breaking barriers and executing complex moves